If You're A Senior On Social Security And You Don't Take Advantage Of These "Lucrative" Offers In January, You'll Regret It Big Time

by Sean Freeman January 2026

by Sean Freeman January 2026

If you rely on Social Security but still find it tough to make ends meet, you need immediate support. The good news is you don’t have to wait months or years for the administration to roll out changes.

There are genuine benefits and private programs available right now that can help you regain financial stability. We’ve done the research and compiled a list of resources that could make a meaningful difference.

💡 Why You Should Pay Attention:

Many of these opportunities can provide thousands of dollars in assistance—and as of March, they’re still active. Though some have already ended, we’ve verified the ones below, and they’re here to help seniors right away.

Don’t Miss Out: Time is ticking on these offers, so make sure you take action sooner rather than later. Whether you’re facing medical bills, house repairs, or simply trying to stretch your income, the following resources could be your lifeline.

👉 Keep reading to discover which benefits you can claim before they disappear.

1. Medicare Advantage Plans Now Include $3,600+ in Extra Benefits

Did you know that seniors can access Medicare Advantage plans that include benefits Original Medicare doesn't cover?

These enhanced plus plans now offer dental coverage, vision care, hearing aids, prescription drug coverage, and even fitness memberships – all with zero monthly premium for qualifying individuals.

Even better, some plans now provide grocery allowances, transportation to medical appointments, and in-home support services. In 2025, many plans have expanded to include telehealth services and meal delivery.

Don't miss out on these valuable benefits that could save you thousands annually. Compare available plans in your area today and see what additional benefits you are eligible for.

2. Social Security "Catch-Up" Payments Going Unclaimed

Millions of Social Security recipients are missing out on hard earned benefits. According to recent studies, the average recipient loses out on $111,000 in lifetime benefits due to claiming at the wrong time or missing eligible benefits.

Most seniors don't realize they could receive an extra $1,830 per month by claiming these hidden benefits. You might qualify for spousal or survivor benefits even if divorced, be eligible for special credits that boost monthly payments, and even take advantage of do-over options if you claimed too early.

Don't leave money on the table that rightfully belongs to you. A simple benefits check could identify thousands in additional benefits you're entitled to receive.

3. Senior Homeowners Are Getting New Windows Using This Service

Thanks to this company, senior homeowners no longer need to pay an arm and a leg to get new windows. Many homeowners want to replace old windows for new energy-efficient windows that provide a 100% seal (they don’t let air in or out). This lowers energy consumption, since your home stays cooler longer in the summer, and warmer longer in the winter.

This website allows you to see if you qualify, and shows you the rates you can take advantage of.

It could end at any given time in 2025, but the good news is that once you’re in, you’re in. If your windows are older than 5 years, you may consider replacing them for new energy-efficient windows. Not only will you save on electricity in the long term, but you’ll get a bargain rate right now. There’s absolutely NO COST to see if you qualify.

Do you qualify for new windows? Check if you meet these 3 simple requirements:

- You own a home.

- Your windows are over 6 years old.

- You live in a qualifying zip code.

4. Burial Costs Are Out of Control — This Final Expense Policy Can Help

Funeral costs have skyrocketed over 200% in the past two decades. Today, the average service can cost between 9,000 and 15,000 — creating an unexpected financial burden many families are not prepared to face.

Final expense insurance is designed to help ease that burden. It offers guaranteed coverage specifically for end-of-life expenses, helping ensure your loved ones are protected during a difficult time. These policies are ideal for individuals aged 50 to 75, with guaranteed acceptance, no invasive health questions, fixed premiums that never increase, lifelong coverage, and quick approval.

Best of all, monthly premiums start at just a few dollars a day* making this essential protection truly affordable.

5. VPN Protection Securing Seniors' Online Banking

With online scams targeting seniors at record levels, protecting your digital privacy has never been more important. Hackers are using frightening new methods to drain seniors' bank accounts – and regular security software can't stop it.

This advanced "man-in-the-middle" attack intercepts your banking information even on secure websites. Over $1.9 billion was stolen from seniors last year alone using this technique!

A personal secure Virtual Private Network (VPN) creates an encrypted connection that prevents hackers from accessing your financial information, protects your identity when using public WiFi, and secures your personal data when banking online.

Special programs for seniors now offer premium VPN protection for as little as $1.99 per month – a small price for peace of mind and security in today's digital world.

6. Roof Replacement Fund for Senior Homeowners

Your roof is your home's first line of defense from nature, but most homeowners don't realize that an aging roof can cost thousands in hidden damage and increased energy costs.

If your roof is over 10 years old, you may be eligible for complete replacement through special programs for qualifying homeowners. These programs combine insurance benefits, tax incentives, and government assistance to dramatically reduce or even eliminate out-of-pocket costs.

A new roof doesn't just protect your home – it reduces energy bills by up to 30%, prevents costly water damage and mold issues, increases your home's value (average $22,600), and can lower your homeowner's insurance premiums.

Don't wait until leaks or damage occur. Check if you qualify for special roof replacement assistance today.

7. This is the Home Warranty Helping Homeowners Avoid Expensive Repairs

When a major appliance or system fails, the cost of repairs can throw off your entire budget — especially if you're on a fixed income. That’s why more homeowners are turning to home warranty plans that help cover the cost of breakdowns they didn’t see coming.

This Home Warranty has helped thousands of people protect their homes with coverage options that include appliances, HVAC systems, plumbing, electrical and more. A short phone call connects you with a licensed agent who can walk you through flexible plans that fit your needs and budget.

It’s a smart way to plan ahead — and avoid the stress of unexpected repair bills down the line.

8. Car Insurance Companies Don't Want You To Know This Rate-Slashing Secret

If you've been with the same auto insurance company for more than two years, you're probably overpaying – by as much as $500 to $1,200 per year.

Here's what insurance companies don't tell you: loyalty doesn't pay. Their algorithms are designed to raise rates gradually on existing customers while offering better deals to new ones especially for seniors!

Seniors with clean driving records are especially likely to benefit from comparison shopping. Many qualify for special discounts based on driving experience, reduced mileage, defensive driving courses, vehicle safety features, and bundled policies.

Take two minutes to compare rates from top providers, and you could pocket hundreds in savings without sacrificing coverage.

9. The Mini Mobile Business Perfect For Semi-Retired Seniors

Looking for an easy way to supplement your retirement income without a huge investment or full-time commitment? This innovative mini mobile business opportunity is perfect for semi-retired seniors.

With just 5-10 hours per week, seniors across the country are earning $1,000 to $3,000 monthly with this flexible business model that requires minimal startup costs (under $500), can be operated from home on your own schedule, utilizes skills and experience you already have, and provides steady, predictable income without physical strain.

The best part? You'll maintain complete independence while building a business that works around your lifestyle – not the other way around.

11. The GLP-1 Weight Loss Revolution Is Now Accessible

Forget everything you thought you knew about weight loss. The breakthrough in GLP-1 medications has changed the game forever, and now these revolutionary treatments are more accessible than ever.

Unlike traditional diets that leave you hungry and miserable, GLP-1 treatments work with your body's own systems to naturally reduce hunger signals, slow digestion so you feel fuller longer, regulate blood sugar levels, target stubborn belly fat, and reduce cravings for sugar and processed foods.

What was once available only to celebrities and the wealthy is now accessible to qualifying individuals through telehealth services, often with costs partially covered by insurance.

12. Know Your Rights After a Car Accident

Did you know that seniors involved in motor vehicle accidents often receive lower settlements than they deserve? Insurance companies count on your lack of knowledge about your rights.

Even minor accidents can lead to long-term complications for older adults, with medical costs continuing long after the initial settlement. Many seniors don't realize they may be entitled to compensation for current and future medical expenses, lost income or reduced earning capacity, home modifications if mobility is affected, pain and suffering, and loss of enjoyment of life.

Don't sign anything or accept any settlement until you understand exactly what you're entitled to receive. A free consultation can help protect your financial future.

13. BrainWave Technology Improves Sleep, Focus, and Memory

Cutting-edge binaural wave technology is helping seniors improve sleep, enhance focus, and boost memory – all by simply listening through headphones.

This non-invasive technology uses specifically calibrated sound frequencies to synchronize brainwaves, helping to restore optimal cognitive function without medications or side effects. Research shows regular use can improve sleep quality by up to 65%, enhance focus and concentration, boost memory retention, reduce stress and anxiety, and support overall brain health.

The process is simple – just 15-30 minutes daily while relaxing. Many users report noticeable improvements within just 14 days of consistent use.

14. Convert Your Bathroom From Dangerous to Accessible in Just One Day

Did you know the bathroom is the most dangerous room in your home? For seniors, standard bathtubs pose a serious fall risk that increases with age.

Now, innovative shower-to-bathtub conversion systems can transform your dangerous bathroom into a safe, accessible space in just ONE DAY – without costly, weeks-long renovations or plumbing changes.

These modern conversion systems feature low-entry thresholds for easy access, built-in seating for comfort and safety, slip-resistant flooring to prevent falls, grab bars and safety features, and therapeutic jets for pain relief (optional).

Even better, qualifying seniors may be eligible for special financing programs that make these life-changing conversions affordable on any budget.

15. Access Up to $35,000 with Affordable Home Improvement Loans

Home repairs and modifications don't have to drain your savings. Special home improvement loans for seniors can provide up to $35,000 in funding with affordable monthly payments and fixed interest rates.

These senior-friendly loans can be used for safety modifications like ramps and grab bars, energy-efficient upgrades that reduce utility bills, roof repair or replacement, kitchen and bathroom remodels, HVAC system replacements, and much more.

Many loans require no equity, have simplified approval processes, and offer terms specifically designed for those on fixed incomes. Some programs even reduce interest rates for energy-efficient improvements.

16. Secret Home Buying Programs for Seniors

Thinking of downsizing or relocating for retirement? Little-known home buying programs for seniors can save you thousands in closing costs, reduce down payments, or even eliminate mortgage insurance.

Most real estate agents won't tell you about these special programs because they don't directly benefit from them. These opportunities include reverse purchase mortgages that eliminate monthly payments, special low-down-payment options for seniors, property tax freezes or reductions, energy efficiency grants and incentives, and closing cost assistance programs.

A specialized housing counselor can identify which programs you qualify for based on your specific situation and location.

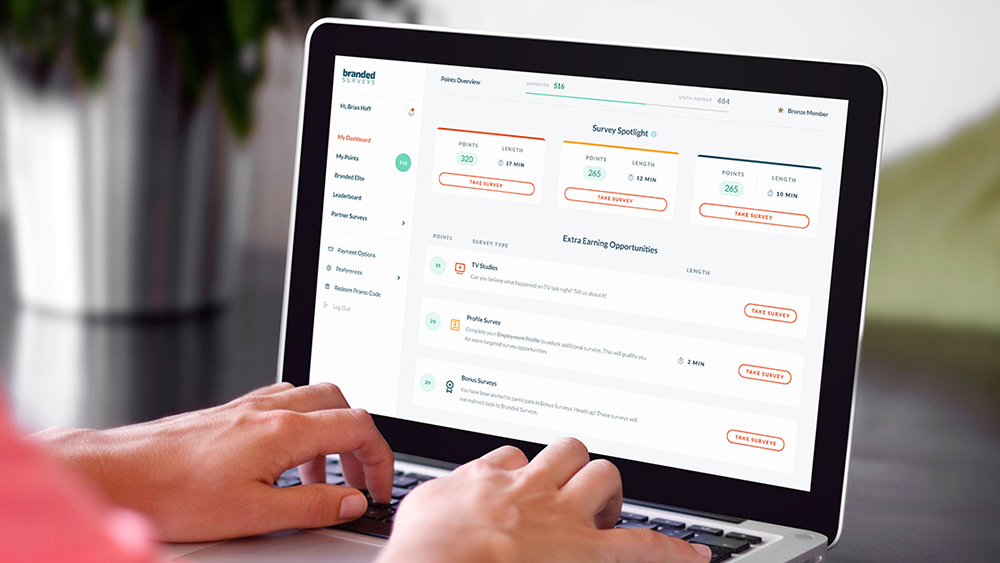

17. Turn Your Free Time Into Extra Cash: Earn $500+ Monthly

Looking for an easy way to supplement your retirement income? Thousands of seniors are earning $500 to $1,500 monthly by participating in market research, surveys, and cashback programs – all from the comfort of home.

These legitimate opportunities require no special skills or experience, just your honest opinions and everyday activities. Popular options include paid product testing and reviews, online survey participation, mystery shopping assignments, cashback programs for everyday purchases, and focus group participation.

These flexible opportunities let you work whenever and however much you choose, making them perfect for retirees looking to boost their income without commitments.

18. The Senior's Guide to Legitimate Sweepstakes

Did you know there are thousands of legitimate sweepstakes specifically designed for seniors with better odds than the lottery and zero cost to enter?

While scams exist, knowing how to identify legitimate opportunities can lead to real winnings. Savvy seniors are using specialized services to find and enter verified contests with prizes ranging from cash and gift cards to vacations and vehicles.

The key is efficiency – using tools that help you quickly enter multiple contests while avoiding the countless hours of searching and form-filling that most people waste time on.

19. The Metabolism Secret for Senior Weight Loss

Forget calorie counting and grueling exercise routines. A groundbreaking approach to weight loss for seniors targets the real culprit behind age-related weight gain: metabolic slowdown.

This innovative method works by reactivating dormant metabolic pathways that naturally decline with age. Users report losing 15-30 pounds without strict dieting, reduced joint pain as weight decreases, improved energy levels throughout the day, better sleep quality and reduced inflammation, and decreased dependence on certain medications.

The program adapts to your specific metabolism and health needs, making it especially effective for adults over 60 who haven't had success with conventional diets.

21. Struggling With Debt in Retirement? This Program Is Giving Seniors a Fresh Start

If you're over 50 and feeling overwhelmed by credit card or personal loan debt, you're not alone—and help is available. A growing number of seniors are turning to this top-rated debt relief program to finally break free from financial stress. With options to reduce what you owe, lower monthly payments, and avoid bankruptcy, it's helping retirees breathe easier and regain control. Find out how it works and see if you qualify in just minutes.